Start-up costs and allowances

Page updated on 22/10/2024

MEDIATION ALLOWANCE, TAX BENEFITS AND TAX CREDIT

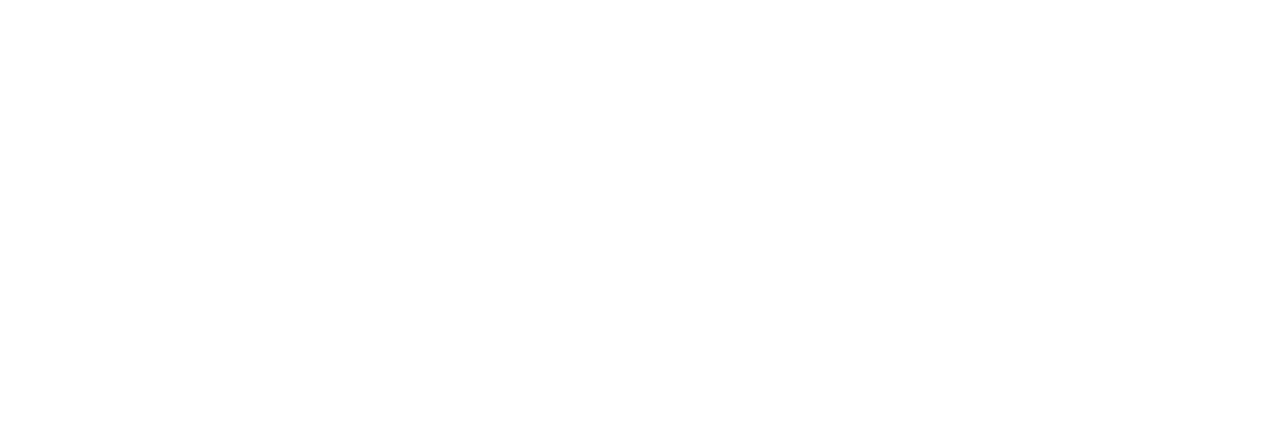

All the minimum amounts indicated in the following tables for the reference brackets are mandatory pursuant to paragraph 4 of art. 31 of Ministerial Decree 150/231 of Ministerial Decree 150/23

A. ALLOWANCES AND EXPENSES FOR THE CONDUCTION OF THE FIRST ACTUAL MEDIATION MEETING

Pursuant to art. 28 of the Decree of the Ministry of Justice no. 150 of 2023, for Mediation procedures initiated with an application submitted from 15 November 2023 each party is required to pay an amount as compensation including the start-up costs and the mediation costs for the first effective mediation meeting lasting a maximum of two hours, in addition to out-of-pocket expenses. These amounts are due by each of the Parties, respectively, upon submission of the Mediation application and at the time of Adhesion. The start-up costs are due by each Requesting Party and each Invited Party; the mediation costs are paid by centers of interest.

For contentious matters for which the mediation meeting is a condition of admissibility (“mandatory matters”), for mediations delegated by the judge and by contractual clause, the amounts are reduced by one fifth pursuant to art. 28, paragraph 8, of Ministerial Decree 150/2023.

For all matters of civil and commercial litigation relating to available rights3 (so-called “voluntary matters”)

Out-of-pocket expenses pursuant to art. 28 c. 3 of Ministerial Decree 150/2023

Service for sending summonses via postal service:

- Free for calls via PEC;

- €10.00 VAT for the service of sending a single registered letter with return receipt;

Digital signature service for signing minutes and agreements via a specific platform:

- €5.00 VAT for each signature and retention of the report in accordance with CAD.

Copy Release Service

- Free

The request for mediation may be registered only after the payment of the expenses due by the Requesting Party. Membership is considered perfected only after the payment of the expenses due by the Invited Party. The express waiver of the Requesting Party to the Mediation procedure, even before the first meeting, does not give rise to the reimbursement of the fees paid. The request is considered waived without the right to reimbursement of the amount already paid in the event of failure to pay the entire amount of the fee due.

The first meeting takes place on the same day with a maximum duration of two hours and cannot be extended to subsequent dates. Any meeting that lasts more than two hours will be considered a subsequent meeting.

When the first meeting ends without conciliation and the proceedings do not continue with subsequent meetings, no further amount is due in addition to the amount already paid for the first meeting.

During the first meeting, the Head of the Organization and/or the designated Mediator will illustrate the additional Mediation costs due for subsequent meetings based on the following criteria and tables regulated by Ministerial Decree 150/23 and the related payment methods.

B. MEDIATION COSTS IN THE EVENT OF CONCILIATION AT THE FIRST MEETING AND FOR THE CONDUCTION OF SUBSEQUENT MEETINGS (MINIMUM AMOUNTS APPLIED BY THE CONCILIATION BODY CONCORDIA ET IUS SRL)

In the event of Conciliation at the first Mediation meeting and when the proceedings continue with meetings subsequent to the first and conclude without Conciliation, the Parties are required to pay the additional mediation costs indicated in the following table (art. 30 of Ministerial Decree 150/23), corresponding to the minimum mandatory amounts applied by the Conciliation Body Concordia et Ius srl of the relevant value brackets of Table A of Ministerial Decree 150/23.

With the agreement of the Parties, for Mediations of particular complexity, amounts different from the above table may be applied within the limit of the minimum values of the subsequent bracket.

C. SURCHARGES IN CASE OF CONCILIATION AND COMPLEXITY

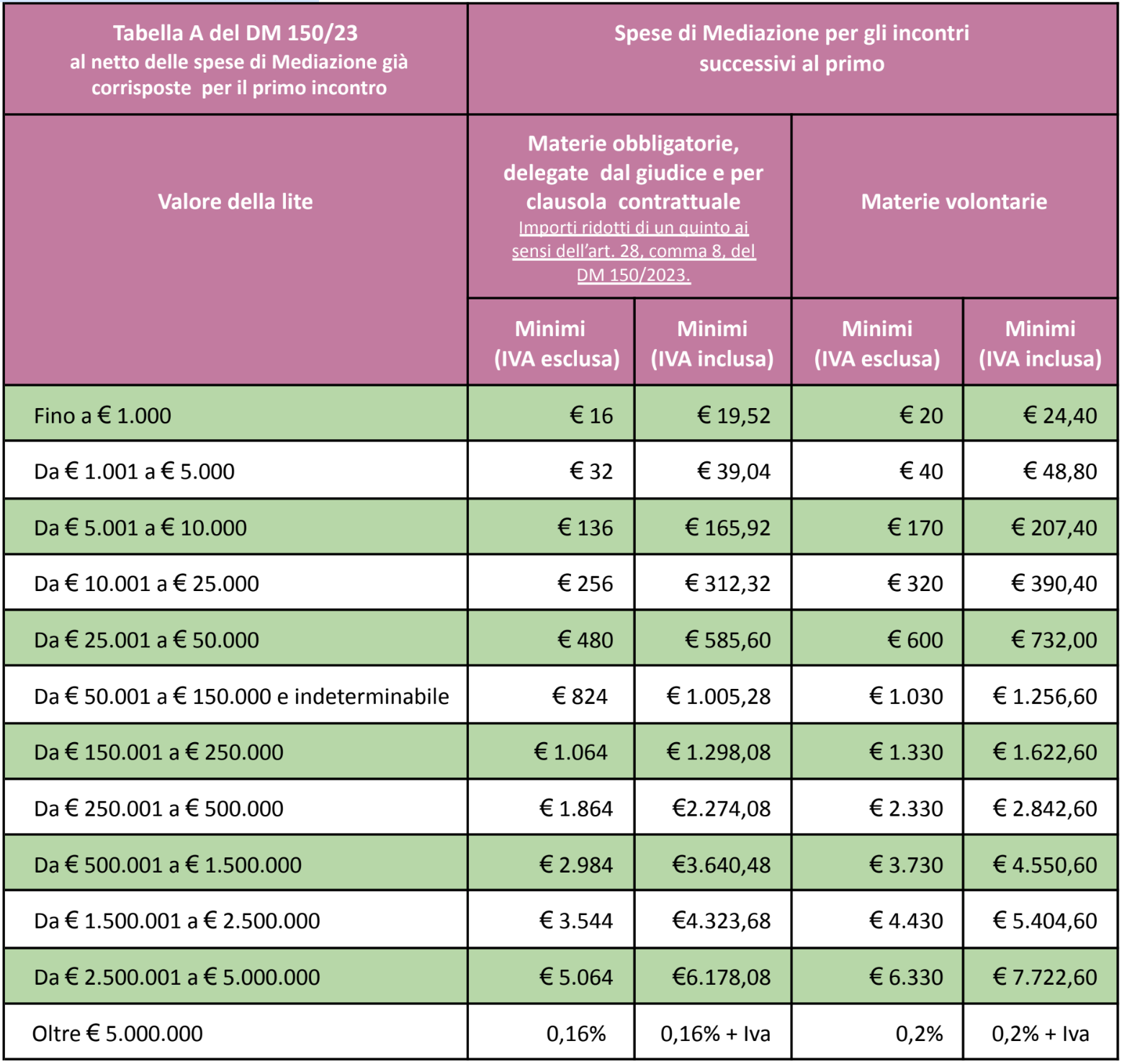

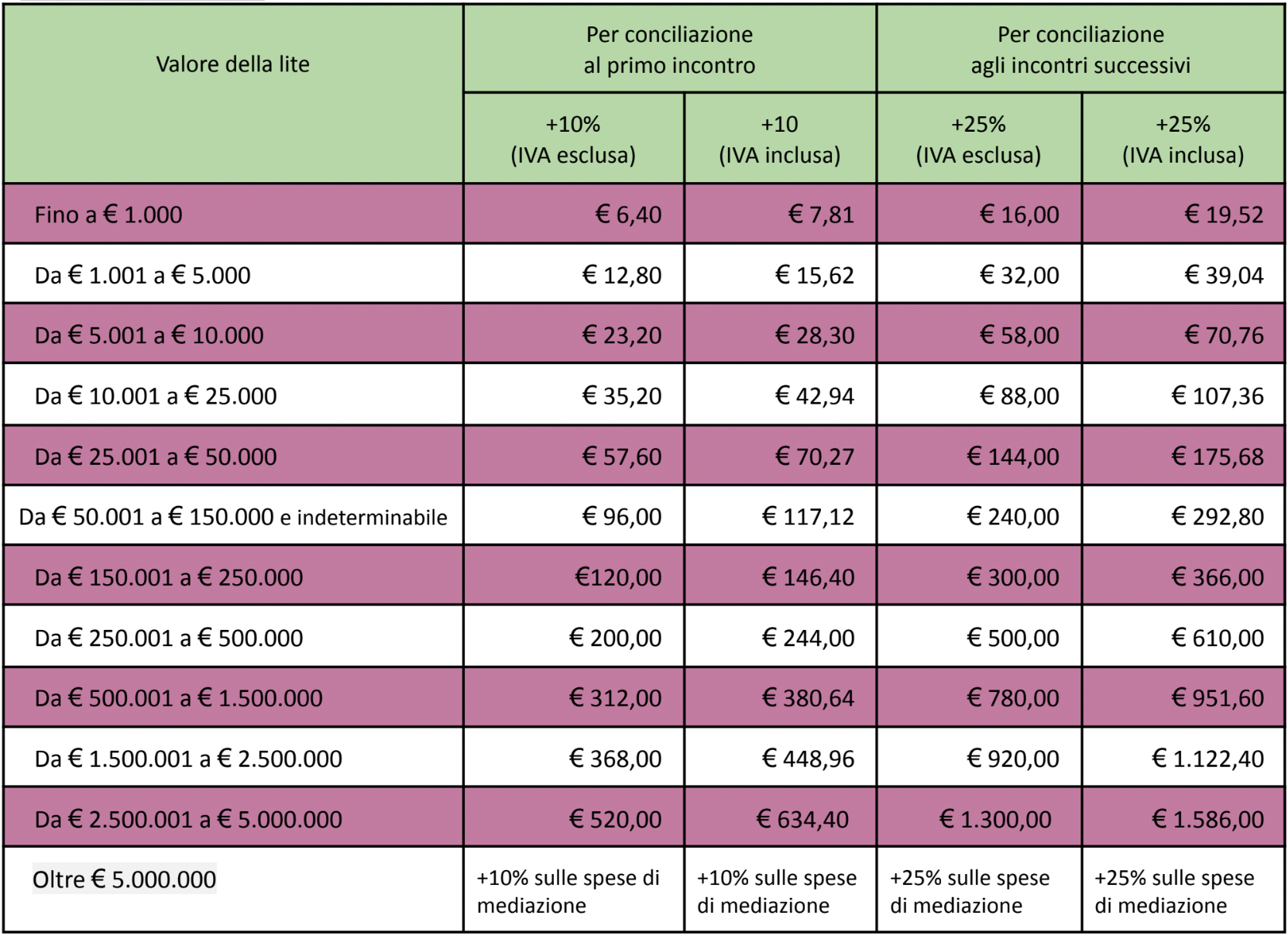

In the event of Conciliation at the first meeting or in meetings subsequent to the first, the Mediation costs reported in the previous table are subject to the following increases to be paid at the conclusion of the procedure for the delivery of the final mediation report (art. 30 of Ministerial Decree 150/2023).

Surcharges for conciliation in the so-called "mandatory matters", for mediations delegated by the judge and for contractual clauses

Conciliation surcharges in all matters of civil and commercial litigation relating to available rights (so-called “voluntary matters”)

Surcharges for complexity and experience of the mediator

Pursuant to art. 31, paragraph 3, of Ministerial Decree 150/2023, in the event of Conciliation in meetings subsequent to the first, in addition to the increase for Conciliation, Mediation costs may be increased by up to twenty percent, based on the existence of at least one of the following criteria:

a) experience and competence of the Mediator appointed upon mutual indication of the parties;

b) complexity of the issues under the procedure, such as the commitment required of the Mediator,

also assessable, but not exclusively, on the basis of the number of meetings.

D. DETERMINATION OF THE VALUE OF THE DISPUTE

Pursuant to art. 29 of Ministerial Decree no. 150/23, the value of the dispute is indicated in the Mediation request in accordance with the criteria set out in articles 10 to 15 of the Code of Civil Procedure. When such indication is not possible, the request indicates the reasons that make its value indeterminable.

The act of accession introducing a further application indicates its value. When the application or the act of accession do not contain the indications on the value of the dispute, or the Parties do not agree on its value, or the aforementioned criteria have been applied incorrectly, the value of the dispute is determined by the Body with an act communicated to the Parties.

The value of the dispute may be determined again by the Organization upon indication of the Parties or upon notification of the Mediator, when new elements of evaluation or new facts alleged by the Parties arise during the proceeding. When the agreement defines additional issues with respect to those considered for the determination of the value of the proceeding, the Organization determines the value by communicating it to the Parties.

E. TAX RELIEF

Pursuant to the Legislative Decree 28/10 as amended and the Decrees of 1 August 2023, the Parties are entitled to the following tax benefits:

- The minutes containing the Conciliation Agreement are exempt from registration tax up to a value limit of €100,000, otherwise the tax is due only for the excess portion.

- A tax credit of up to €600 for Mediation fees and lawyers' fees for each mediation procedure up to an annual total of €2,400 per individual and €24,000 per legal entity. The tax credit is reduced by half in the event of failure to reach Conciliation.

- A tax credit of up to €518 commensurate with the unified contribution paid by the party to the judgment extinguished following the conclusion of the Conciliation agreement.

- Legal aid at the expense of the State to the indigent party for the assistance of the Lawyer if an agreement is reached in Mediation in the matters covered by the condition of admissibility.

- Legal aid at the expense of the State to the non-wealthy Party for Mediation fees, regardless of the outcome of the Mediation.

The payment of the start-up costs, the out-of-pocket costs and the Mediation costs, together with the communication of the data for electronic invoicing when filling out the Mediation and Membership application, is a necessary condition for the issuing of the reports.

E. BILLING DATA AND TAX CREDIT

The Parties in Mediation must indicate the data for issuing the invoice at the time of filing the application and joining.

To access the benefits provided by the tax credit regulated by the Decree of the Ministry of Justice of 1 August 2023, the beneficiary must produce by 31 March of the year following the conclusion of the mediation procedure - through a platform made available by the Ministry of Justice currently being set up - the invoice issued by the Conciliation Body Concordia et Ius srl (in the name of the beneficiary), proof of payment, the identification data of the Mediation procedure and its outcome.

To this end, the Organization will issue invoices to the parties in Mediation who have made the relevant payments. Payment of fees and request for invoices to be issued to parties other than the parties involved in Mediation may not allow access to the benefits provided by the tax credit.